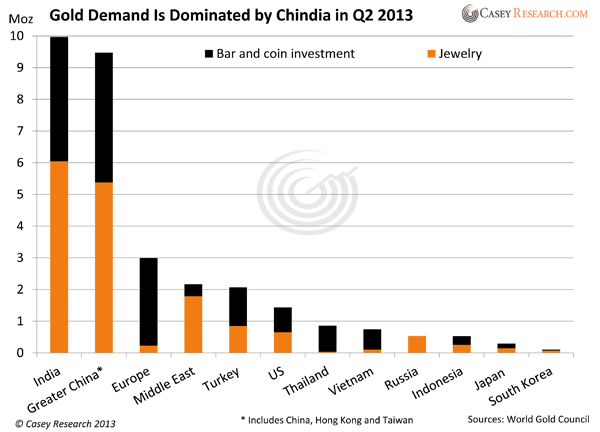

Have you had a chance to read Peter Schiff’s October Gold Letter? Besides Peter’s incisive commentary on the Fed’s “taper fakout,” Jeff Clark of Casey Research has a fascinating piece on Chinese gold demand. While Western bankers like Goldman Sachs are predicting a major downturn in the price of gold, everyday Chinese are hoarding the yellow metal like there’s no tomorrow.

“Goldman Sachs is once again predicting that gold will fall, setting a new near-term target of $1,050.

Never mind the schizophrenic gene that would be required to follow the constantly fluctuating predictions of all these big banks; it’s amazing to me that anyone continues to listen to them after their abysmal record and long-standing anti-gold stance.

Sure, the too-big-to-fails can move markets – but they say things that are good for them, not us. For example, while Goldman Sachs was telling clients and the public to sell gold in the second quarter of 2013, they bought 3.7 million shares of GLD and became the ETF’s 7th largest holder.

When I visited China two years ago, guess who no one was talking about? Goldman Sachs.”

Read the Full Article Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Chinese Housewives vs Goldman Sachs: No Contest

Have you had a chance to read Peter Schiff’s October Gold Letter? Besides Peter’s incisive commentary on the Fed’s “taper fakout,” Jeff Clark of Casey Research has a fascinating piece on Chinese gold demand. While Western bankers like Goldman Sachs are predicting a major downturn in the price of gold, everyday Chinese are hoarding the yellow metal like there’s no tomorrow.

Read the Full Article Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!