Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

Top Signs the Dollar Is Doomed

Eddie van der Walt at the Bullion Desk interviewed James Rickards last week about the US dollar and gold. Rickards discussed some of the important signs that will signal the end of the world’s reserve currency, many of which are already occurring. Richards argues that gold is one of the best assets to protect yourself from the dollar’s collapse.

“The most likely outcome is some sort of catastrophic collapse, he said. ‘You could have a hyper-inflationary outburst, followed by collapse and social disorder, followed by some sort of neo-fascist deflation.’

Flowing from this, he said, the US currency will be devalued against gold – meaning large increases in the dollar price of gold.

Rickards predicts gold at $9,000 per ounce if the world moves to a quasi-gold-backed currency.

‘This is how things played out between 1921 and 1934 in Germany, so there is a precedent,’ he said.

But he says that there may be hope for investors even in such dark times. “Perhaps you, the individual, cannot stop the catastrophe, but you can protect yourself.

‘You don’t have to wait for a gold standard, you can put yourself on a gold standard by going out and buying some physical gold.'”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

1 Comment

Gold for the Long Run

In a new commentary on MarketWatch, Cody Willard explains his reasoning for holding physical gold and silver for the long-term. In spite of short-term bearish sentiment, Willard has to admit that precious metals are an important part of his portfolio for the next 10 to 50 years!

“That doesn’t mean that I’m selling any of my own holdings of physical gold and silver coins and bullion. Far from it. I’d welcome yet another opportunity to scale into more physical gold if there were to be another near-term crash in its prices. I plan to own my own physical gold basically for the next 10 to 50 years. Let’s discuss…

We know that the developed world’s governments here and around the world are actively engaging in broad-reaching currency wars, mostly trying to keep their currencies weak in the name of spurring export growth and helping transnational conglomerates maximize their reported earnings. We know that the Fed is in way uncharted (and frankly, un-”chartered“) territory using all kinds of tools like 0% interest rates and QE and so on to artificially repress interest rates and force people to take on excess risk in search of yield.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Gold for the Long Run

World Gold Investment Is Too Low

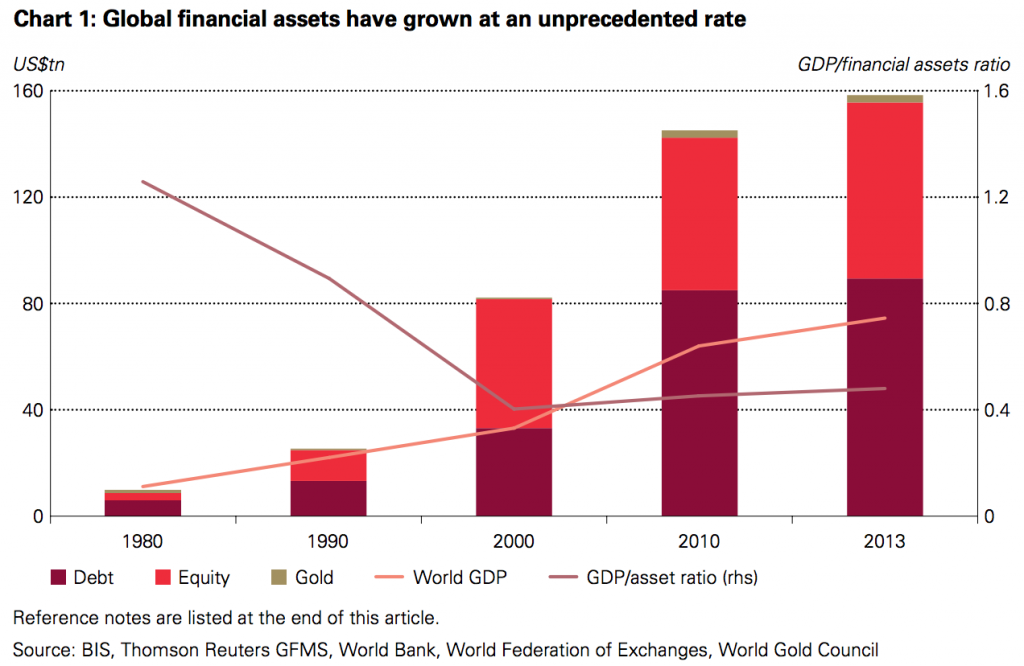

According to the World Gold Council’s latest research, most investors are under-allocated to physical gold. In the latest edition of Gold Investor, the WGC explains the importance of gold in an expanding and overvalued global financial system.

“Despite a significant price pullback mostly during 2013, gold has risen for most of the past decade on the back of growth in emerging markets, economic uncertainty, central-bank demand and constrained supply. Even so, gold remains a widely under-owned asset. Gold holdings account for 1% of all financial assets – a by-product both of its scarcity and the unprecedented growth in other financial assets. Further, gold’s low ownership rate stands in stark contrast to levels seen in past decades, as well as what research suggests optimal gold allocations should be.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on World Gold Investment Is Too Low

Gold’s Purpose in a Paper World (Video)

On Yahoo! Finance’s The Daily Ticker, Jim Rickards defends gold as an important safe-haven asset for every investor. Rickards says we must ignore the bearish sentiment and focus on the excellent fundamentals that have not been affected by 2013’s downturn. As confidence in paper currencies collapses, look for gold to rise again.

“When confidence is lost in paper currencies, [it could be that] the IMF, or the Fed, or the ECB have to restore confidence. How do you do it? One way to do it is to go back to a gold standard. If you go back to a gold standard, you have to get the price right. $7,000 to $9,000 is the implied non-deflationary price… A lot of people say you can’t have a gold standard because there’s not enough gold. That’s nonsense, there’s always enough gold, it’s just a question of price.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Gold’s Purpose in a Paper World (Video)

Fed Policy Will Bring Economic Calamity (Video)

David Stockman, a former Director of the Office of Management and Budget under President Reagan, shared with CNBC his thoughts about the Federal Reserve’s policies. Like Peter Schiff, Stockman had no kind words to spare for Fed.

“This whole taper kabuki dance is a farce, really. It will end up in a gong show, a cacophony at the Fed, confusion in the markets, and calamity for the economy. They never should have painted themselves so deep into this QE corner in the first place, because you know the whole predicate is false. We didn’t need zero interest rates for seven years, because we’re already at peak debt. Forcing more credit into the economy didn’t work, it just encouraged gambling on Wall Street, and fiscal irresponsibility in Washington.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Fed Policy Will Bring Economic Calamity (Video)

The Fed Is Shooting Blanks

The Federal Reserve’s narrative that the US economy is improving and that the stock market isn’t in a bubble is starting to stretch the imagination of even the mainstream media. Here’s a new commentary published by USA Today that picks apart the idea that the Fed’s stimulus is doing anything to help the economy. The author even notes, as Peter Schiff has been pointing out for months, that Yellen reserves the right to reverse coarse and increase quantitative easing should the Fed deem it necessary.

“I couldn’t believe my ears on Thursday when I saw a fellow on CNBC say with a straight face ‘well, the economy really is getting better this year.’ The economy is only getting better on the same basis it’s gotten better the last five years – somewhere over the rainbow.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Fed Is Shooting Blanks

People Will Run to Gold in the Next Crisis (Video)

Jim Rickards was interviewed by Dutch financial news station RTL Z about the coming financial crisis. Like Peter Schiff, Rickards sees gold playing a huge role in the future of international currencies.

“What was too big to fail in 2008 is even bigger today. Which means that the next crisis will not just be bigger, but exponentially bigger. And the difference this time… is that it will be bigger than the Fed… That will lead to a collapse of confidence in the dollar and the replacement by something else… It could be gold. In either case, people will run to gold because it’s the one thing you can’t print. It’s the one thing that’s not digital. It’s not bitcoin. It’s actually real. So the implied price of gold in that world will be $7,000 an ounce or perhaps higher.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

1 Comment

The Dollar Collapse Will Happen Quickly (Video)

Jim Rickards was interviewed on RT’s Boom Bust about the impending death of the US dollar. It could happen tomorrow or in several years, but Rickards is convinced that the world is ready to leave the dollar behind and move on to a more stable form of money.

“Russia is ready to turn their back on the dollar… China, we know, is buying gold, thousands of tons of gold… Iran has been importing gold from Turkey. Look around the world, a lot of people are ready to turn their back on the dollar. They haven’t done it yet, but when the confidence is lost it can be lost very quickly. Investors need to be prepared for that.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

1 Comment

Top 12 Signs of Looming US Recession

Politicians and the Federal Reserve are spinning tales of a slow but steady economic recovery in the United States. But economists and financial advisors like Peter Schiff are not fooled by the double speak. The Economic Collapse Blog published a good summary of recent major economic data and news that indicate the picture is not nearly as rosy as Washington would like us to believe.

“Is the U.S. economy steamrolling toward another recession? Will 2014 turn out to be a major “turning point” when we look back on it? Before we get to the evidence, it is important to note that there are many economists that believe that the United States never actually got out of the last recession.

For example, data compiled by John Williams of shadowstats.com show that the U.S. economy has continually been in recession since 2005. So if anyone out there would like to argue that America is experiencing a recession right now, I certainly would not have a problem with that. In fact, that would fit with the daily reality of tens of millions of Americans that are deeply suffering in this harsh economic environment. But no matter whether we are in a “recession” at the moment or not, there are an increasing number of indications that we are rapidly plunging into another major economic slowdown. The following are the top 12 signs that the U.S. economy is heading toward another recession…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

1 Comment

Outsmarting Money-Printing with Gold & Silver (Video)

Greg Hunter of USAWatchdog interviewed Axel Merk about a broad range of topics this week. Merk talked about how the Federal Reserve’s policies do nothing for Main Street and why Yellen’s Fed is not going to stop the money spigot or raise interest rates anytime soon. They also spoke about the shortages of physical gold and silver due to higher and higher safe haven demand.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!