Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Monthly Archives: October 2013

Rickards: We’re In a Depression (Video)

Yesterday, on Yahoo! Finance, Jim Rickards spoke with Lauren Lyster about how Janet Yellen will perform as Chairman of the Federal Reserve. Rickards agrees with Peter Schiff, reasoning that Yellen is going to keep the stimulus flowing. He also explained why he thinks the US is actually in a depression and will be experiencing a recession within that depression next year!

“You can have a recession within a depression, in fact I expect a recession next year… This recovery is four years old. The average recovery is fifty months or so… Besides that, with the sequester, the government shutdown… Fewer and fewer people are working, so I don’t see where the drivers of growth are coming from.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Rickards: We’re In a Depression (Video)

Today’s Key Gold Headlines – 10/11/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 10/11/13

Yellen Will Be a Dangerous Fed Chairman (Video)

Yesterday, on Business News Network, Peter Schiff spoke about the disastrous consequences of choosing Janet Yellen as Chairman of the Federal Reserve. He also explained why government spending should be dramatically cut, rather than raise the debt ceiling. If you agree with Peter that the US is on the road to ruin, consider diversifying out of the US dollar – buy physical gold and precious metals.

“[Yellen’s] going to spike the punchbowl with even more alcohol. She’s going to take the $85 billion a month in QE that we’re getting now and she’s going to take it up a few notches… She’s going to resist the cure as long as possible. She actually thinks inflation is good, that you create prosperity and growth and jobs by debasing money. So this is a very dangerous person at a very dangerous time to be heading a very dangerous institution like the Fed.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Videos

Comments Off on Yellen Will Be a Dangerous Fed Chairman (Video)

Today’s Key Gold Headlines – 10/10/13

- China’s Hunger for Gold Triggers Speculation about Reserves, Wall Street Journal

- India Gold Premiums Soar as Festival Season Begins, Wall Street Journal

- California, Government Shutdown Lift US Jobless Claims to 6-Month High, Reuters

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 10/10/13

Priced in Gold, American Wages Are Dismal

Forbes published an eye-opening op/ed by Keith Weiner of the Gold Standard Institute today. Weiner first looks at the government’s historical data on the costs of consumer goods and employee salaries. He then looks at the same data in terms of gold ounces, revealing that American workers are laboring longer for dramatically less pay than their parents. Not only that, but their purchasing power has also plummeted since the 1960s, before Nixon completely severed the US dollar from the gold standard.

“By switching to gold, we can measure both wages and prices on an absolute scale—in ounces—and we can make precise comparisons. To convert the price of anything to gold, just divide the price by the current gold price. For example, in 2011 if a big-screen TV was $785, then divide that by the gold price of that year; the television set cost half an ounce of gold.

The bottom line is that, in terms of gold, wages have fallen by about 87 percent. To get a stronger sense of what that means, consider that back in 1965, the minimum wage was 71 ounces of gold per year. In 2011, the senior engineer earned the equivalent of 63 ounces in gold. So, measured in gold, we see that senior engineers now earn less than what unskilled laborers earned back in 1965.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Priced in Gold, American Wages Are Dismal

Today’s Key Gold Headlines – 10/9/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 10/9/13

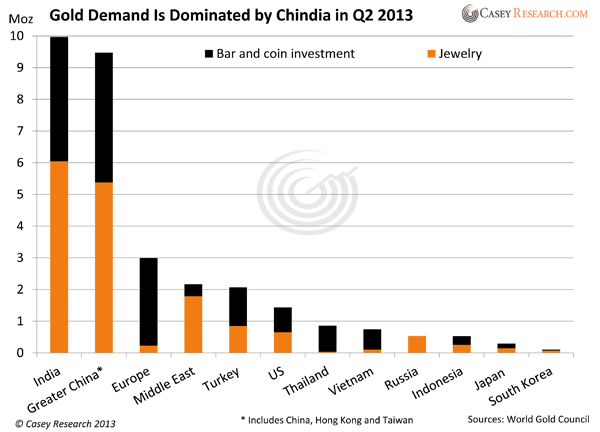

Chinese Housewives vs Goldman Sachs: No Contest

Have you had a chance to read Peter Schiff’s October Gold Letter? Besides Peter’s incisive commentary on the Fed’s “taper fakout,” Jeff Clark of Casey Research has a fascinating piece on Chinese gold demand. While Western bankers like Goldman Sachs are predicting a major downturn in the price of gold, everyday Chinese are hoarding the yellow metal like there’s no tomorrow.

“Goldman Sachs is once again predicting that gold will fall, setting a new near-term target of $1,050.

Never mind the schizophrenic gene that would be required to follow the constantly fluctuating predictions of all these big banks; it’s amazing to me that anyone continues to listen to them after their abysmal record and long-standing anti-gold stance.

Sure, the too-big-to-fails can move markets – but they say things that are good for them, not us. For example, while Goldman Sachs was telling clients and the public to sell gold in the second quarter of 2013, they bought 3.7 million shares of GLD and became the ETF’s 7th largest holder.

When I visited China two years ago, guess who no one was talking about? Goldman Sachs.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Chinese Housewives vs Goldman Sachs: No Contest

Today’s Key Gold Headlines – 10/8/13

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Daily Gold Headlines

Comments Off on Today’s Key Gold Headlines – 10/8/13

Preparing for a Dollar Collapse (Audio)

This morning, Peter Schiff was interviewed by Mike Slater on KFMB San Diego. Peter explained why raising the debt ceiling is just going to make the real crisis much worse and lead to the inevitable collapse of the US dollar. Peter didn’t have time to advise the listeners on how to protect themselves from this crash, but it’s simple: invest in hard assets like physical gold and other precious metals.

“We’re headed for a real crisis, but it’s not going to be because we failed to raise the debt ceiling, but because we succeed… I believe that the dollar’s days as the world’s reserve currency are numbered. I don’t know how big that number is, but I don’t think it’s going to be a gradual process. I think at one point it’s just going to happen. One day it’s just going to plunge. And I think country’s like China are already preparing for that to happen.”

Listen to the Full Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews

Comments Off on Preparing for a Dollar Collapse (Audio)

Debt Ceiling & Gold – Hype vs Reality (Video)

In his latest video blog, Peter Schiff explains why Goldman Sachs is completely wrong with its prediction that gold will plummet if the debt ceiling is raised. Peter also reminds us that he’s always predicted that Obama would make the worst possible choice for replacing Bernanke as Fed Chairman: Janet Yellen.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!