Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

Be Prepared for Sudden Gold Shortages (Video)

Greg Hunter of USAWatchdog interviewed Jim Rickards, author of Currency Wars and The Death of Money. Rickards spoke at length about gold price manipulation and the inevitable collapse of the US dollar as the world’s reserve currency. Hunter had one big question for Rickards – when will the collapse occur and the price of gold skyrocket? Rickards thinks it could happen within the next two years and that whatever triggers it will be completely unexpected. One thing Rickards is sure about: gold will be hard to acquire by the time people realize the dollar is worthless.

“You got shortage of physical supply, demand coming from China, demand coming from India, etc. This is a recipe for… either a short squeeze, or somebody somewhere not being able to deliver [gold]. Once that becomes apparent, then you could see this scramble to buy gold… That’s what will take down manipulation… Once the market prevails over the manipulators, then watch out.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

1 Comment

Long-Term Gold Demand Remains Strong (Video)

The World Gold Council has released its Gold Demand Trends report for the first quarter of 2014. Marcus Grubb, the Managing Director of Investment Strategy at the WGC, reviews the key points in the short video below. The big takeaway – while investment demand for gold has predictably dropped from the record highs last year, world gold demand remains virtually unchanged year-over-year.

“Gold demand in Q1 2014 was 1,074 tonnes, almost unchanged compared to the same period the previous year. After an exceptional 2013, gold demand has reverted to its long-term growth path, with the core fundamentals firmly in place. Jewelry remains the biggest driver of gold demand… Investment demand remains steady. Central banks also continue to be committed purchasers of gold.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Long-Term Gold Demand Remains Strong (Video)

2013 Physical Silver Demand Hit Record High

The latest World Silver Survey has been released by the Silver Institute. Researched and compiled by Thomson Reuters GFMS, the report is an exhaustive examination of global silver supply and demand data in the previous year.

“Total physical silver demand rose by 13 percent in 2013 to an all-time high, according to “World Silver Survey 2014″, released today by the Silver Institute. This was primarily driven by the 76 percent increase in retail investment in bars and coins coupled with a sturdy recovery in jewelry and silverware fabrication. On the supply side, silver scrap fell by 24 percent, experiencing the largest drop on record to reach its lowest level since 2001. The silver price averaged $23.79 in 2013, the third highest nominal average price on record, in a particularly volatile year for the entire precious metals complex.

Total physical demand for silver stood at a record 1,081 million ounces (Moz) last year. The largest component of physical silver demand, industrial applications, dipped by less than 1 percent to 586.6 Moz, to account for 54 percent of total physical silver demand. Asia, however, experienced a 3 percent increase in silver industrial demand, led by China, where a continued recovery in the electrical and electronics sector, along with gains in the Chinese ethylene oxide industry, took total Asian industrial offtake to a new high. Japan also experienced gains in silver industrial demand.”

Read a Summary and Access the Survey Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on 2013 Physical Silver Demand Hit Record High

Dubai Angling to Become World’s Largest Gold Hub (Video)

Record gold demand in Asia, particularly China and India, has been a hot topic in the precious metals market over the past year. What hasn’t received as much press is the booming gold trade in the Middle East. The biggest news from that region is the soon-to-be largest gold refinery in the world, currently under development by Kaloti Metals in Dubai. The refinery will have an annual capacity three times the size of any other in the region. Here’s what the founder of the company had to say about it in a report produced by Reuters and shared by Yahoo! News:

“Right now, Dubai represents 11% of the world’s gold business. The expectation for 2020 is that this percentage will grow to become the highest in the world at around 39%… Dubai’s future as a world hub for gold business is very promising. As an investment, demand for gold will go on forever. There’s nothing that can replace it.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Dubai Angling to Become World’s Largest Gold Hub (Video)

The Latest Silver Industry News

The latest edition of Silver News from The Silver Institute was released last week. It features a wide range of silver industry news, from the latest silver jewelry buying trends to new applications for the white metal. Some highlights include:

- 92% of jewelry retailers expect robust silver demand will continue for years.

- Tata releases an improved silver-based water purifier for consumer markets.

- New silver smart tags developed in China can indicate when food and medicine is spoiled.

- “Smart holograms” use silver for inexpensive medical testing.

Photo: This small silver smart tag on a bottle of medicine can tell consumers if a product is spoiled without even opening the package!

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Latest Silver Industry News

Get Your Gold Now – Collapse Will Be Sudden (Video)

Jim Rickards, author of Currency Wars and The Death of Money, gave a long and entertaining interview to Hedgeye TV this week. Rickards talked in-depth about the failures of Keynesian monetary policy. Like Peter Schiff, he believes that the Federal Reserve will not be able to successfully taper quantitative easing. Most importantly, Rickards emphasized how quickly the international monetary system will collapse, though exactly what will trigger that collapse is hard to identify. One of your best protections is hard assets, but make sure you buy your gold while you still have the chance!

“[The next collapse] will happen very quickly. You won’t have time to adjust… When you really want your gold, you’re not going to be able to get it, because the big guys will get it. The central banks will have it… multi-billion dollar hedge funds will be able to get some gold… But the mint will stop shipping it, your local dealer will run out…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

1 Comment

Yellenisms – Don’t Worry, Be Happy!

Peter Schiff isn’t the only one skeptical of the Federal Reserve’s cheery forecasts for the US economy. A new commentary at MarketWatch takes a critical look at Janet Yellen’s testimony to the Joint Economic Committee this week. A lot of what Yellen says is simply nonsense, and it doesn’t take a genius to point out all the contradictions.

“Federal Reserve Chair Janet Yellen did a masterful job navigating the political shoals of the Joint Economic Committee yesterday. She told liberal Vermont Sen. Bernie Sanders (I-VT) that she shared his concern about the Koch brothers and inequality, and conservative Indiana Sen. Dan Coats (R-IN) that Congress needed to act soon to reduce long-term budget deficits.

But her testimony, and the discussion that followed it, raised a host of serious questions about the role of the Federal Reserve in this sluggish economy. As Chair Kevin Brady (R-TX) told Yellen, her “don’t worry, be happy” monetary message might not work. From what I heard, there were at least six issues on which she spoke that made no sense. I’ll call them Yellenisms.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Yellenisms – Don’t Worry, Be Happy!

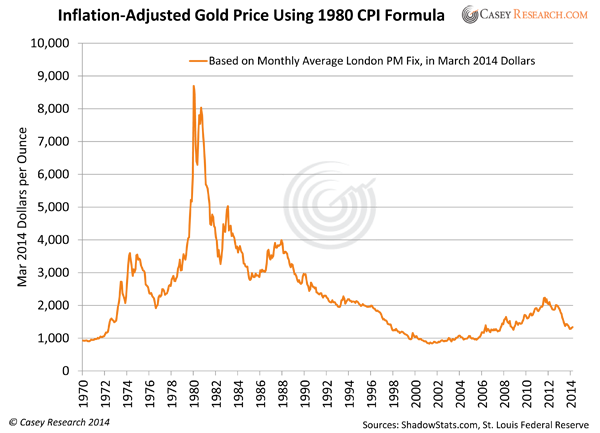

Did Gold Really Peak in 2011?

Jeff Clark’s new commentary at Casey Research takes a look at a misleading chart that has been making the rounds. It purports to show that when you take inflation into account, gold matched its 1980 peak back in 2011. Gold bears look at this as proof that the bull market is over. Not so fast! Clark explains why this chart and the data underlying it are unreliable. The truth is that gold still has a long way to go before matching its 1980 peak.

“Using the 1980 formula, the monthly average price of gold for January 1980 would be the equivalent of $8,598.80 today. The actual peak—$850 on January 21, 1980—isn’t shown in the chart, but it would equate to a whopping $10,823.70 today.

The Shadow Stats chart paints a completely different picture than the first chart. The current CPI formula grossly dilutes just how much inflation has occurred over the past 34 years. It’s so misleading that investment decisions based on it—like whether to buy or sell gold—could wreak havoc on a portfolio.

This could easily be the end of the discussion, but there are many more reasons to believe that the gold price has not peaked for the current bull cycle…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Did Gold Really Peak in 2011?

Watch Out for a Major Market Correction (Video)

Renowned investor Marc Faber spoke with CNBC this week about the over optimism surrounding the US stock market. Faber thinks this is the wrong time to get into US stocks and warns of an inevitable correction. While Faber talks about emerging markets as good investments, don’t forget that this is also a great time to buy into physical gold and silver at very cheap prices.

“I believe it is too late to buy the US stock market… It should be clear to anyone. When prices are low… for stocks and interest rates are very high… then the expected returns are also very high. Whereas, when interest rates are zero… what is your expected return over the next ten years? … In general, individual investors have excessively optimistic expectations about their future returns. “

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Watch Out for a Major Market Correction (Video)

Steve Forbes: Return to Gold Standard for Economic Stability (Video)

Forbes Media Chairman and Editor-in-Chief Steve Forbes spoke with Reuters about his new book Money, which makes the case for reinstating the gold standard.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!