Calls to Action

Archives

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- November 2011

- September 2011

Recent Comments

- Michael P. Shipley on Euro Pacific Precious Metals Is Now SchiffGold

- sell diamonds ny on Destroying the Dollar a Penny at a Time

- Gold and silver buyers on Why Is China Buying So Much Gold?

- Lloyd Bardell on The Swiss Want Even More Economic Freedom (and Gold)

- Klaus on Every Janet Yellen Press Conference Ever in Under 4 Minutes (Video)

Category Archives: Outside Commentaries

Gold Will Have Its Day: A Defense of Peter Schiff

Bloomberg published a feature article this week about Peter Schiff, attempting to paint him as an irrational gold bug and discredit his predictions of the looming economic crisis. The folks at The Daily Bell have published a rebuttal to Bloomberg’s hit piece, explaining some of the finer points of free market economics and why Peter is right about gold’s future.

“Every week or month, Bloomberg editors attack gold and this article, striking out at chief gold bug Peter Schiff, is more of the same.

The bias is subtle but apparent. The article manages to point out that Schiff’s father is in jail for tax evasion and that Peter Schiff has made a personal fortune even while his precious metals recommendations have soured, from a mainstream media perspective.

As editors and writers of an alternative ‘Net publication, we have to admire the way Schiff confronts naysayers and fear mongers when it comes to the economy. As he responded once when we were speaking about free-market economics, ‘What other kind is there?'”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Gold Will Have Its Day: A Defense of Peter Schiff

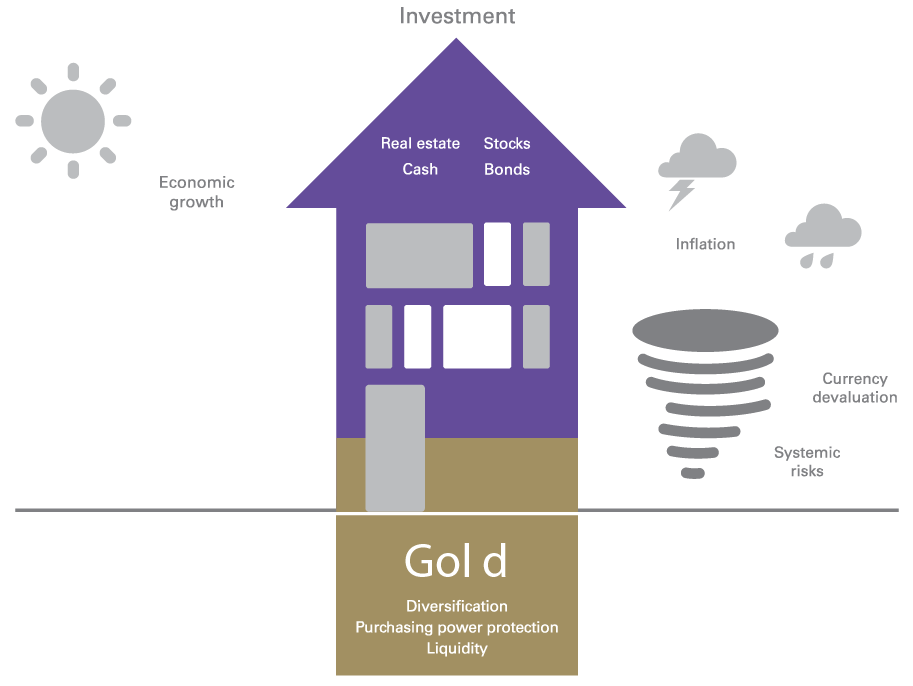

Gold’s Long-Term Risk Management Value

The World Gold Council just released Volume 4 of its Gold Investor. The latest research from the WGC addresses misunderstandings about gold’s value as a long-term hedge against inflation and protector of purchasing power.

“The merits of gold as an investment receives a lot of attention. Investors and market commentators fervently debate whether it could or should be used to protect against inflation, to hedge US dollar exposure, or even tail risk events. And while there is enough literature for and against gold’s roles in a portfolio, or what measures should be used to assess its effectiveness, they are quite often inadequately defined.

Misunderstandings about gold’s properties have led to multiple articles contesting gold’s role as an inflation hedge, currency hedge, and tail risk hedge, among others. We contend that by properly defining these functions and using appropriate measures, gold’s purchasing power preservation qualities and risk management characteristics become apparent. While gold’s ability to hedge inflation or protect against a very specific kind of risk could be replicated by including securities constructed specifically with that objective, these can often be costly and add an additional set of risks, such as credit or counterparty risk exposure.

Gold is a well rounded, cost effective strategic asset, which held even in a modest amounts (typically 2%-10% of a portfolio) can help investors reduce risk without sacrificing long term returns.”

Download and Read Gold Investor Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Gold’s Long-Term Risk Management Value

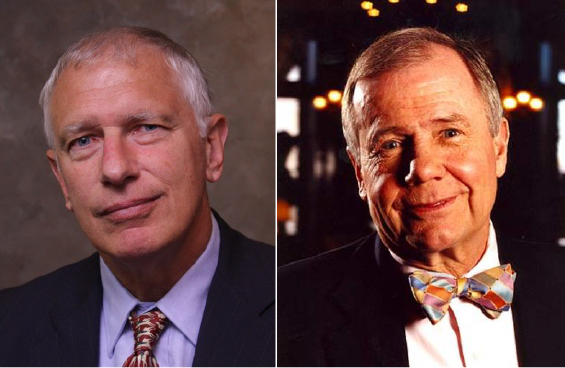

Doug Casey & Jim Rogers: Gold vs Fiat Money (Audio)

Doug Casey and Jim Rogers were recently interviewed on Wall Street for Main Street by Jason Burack. During their hour-long discussion, Doug and Jim delve into the age-old problem of fiat money and government debt, stressing the importance of competing currencies as tools to avoid the inflation created by government money printing. While both are skeptical of a gold backed currency replacing the dollar anytime soon, average investors can still protect themselves from an international currency war by buying physical gold and silver. Both Doug and Jim note that they have no intention of selling their gold in the near future.

Listen to the Full Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on Doug Casey & Jim Rogers: Gold vs Fiat Money (Audio)

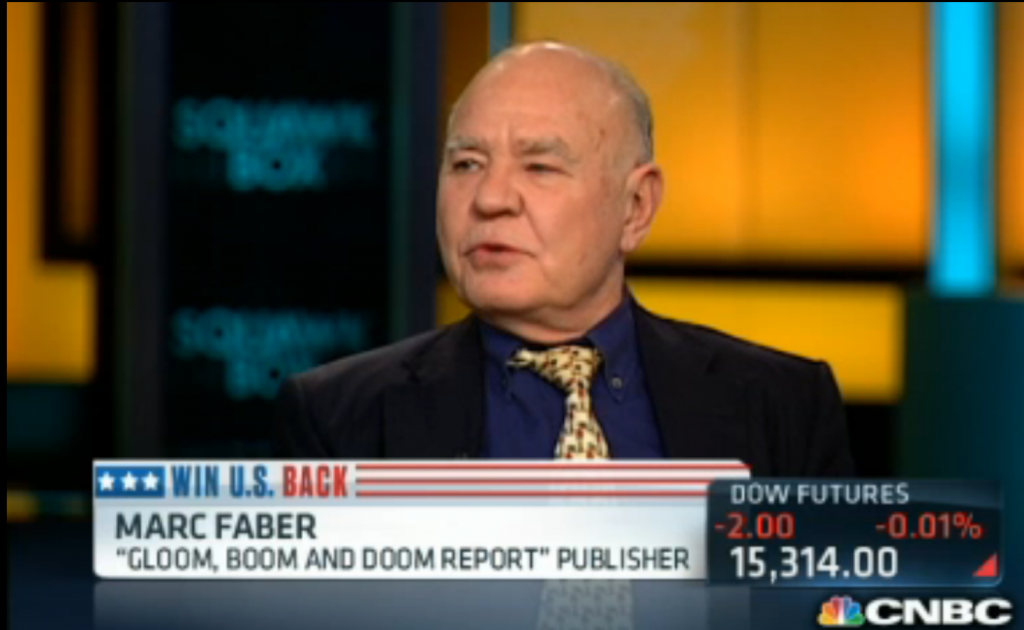

QE Could Rise to $1 Trillion a Month? (Video)

Peter Schiff isn’t the only one who is confident that the Federal Reserve will increase its quantitative easing in the next year. Marc Faber of The Gloom, Boom & Doom Report speaks with CNBC about the Fed’s nonexistent exit strategy and the possibility of increasing the stimulus to $1 trillion a month! Now there is a good reason to buy a safe haven investment like physical gold.

“The Fed has boxed themselves into a position where there is no exit strategy. The question is not tapering. The question is at what point will they increase the asset purchases to say, $150 [billion], $200 [billion], a trillion dollars a month? That is the question.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on QE Could Rise to $1 Trillion a Month? (Video)

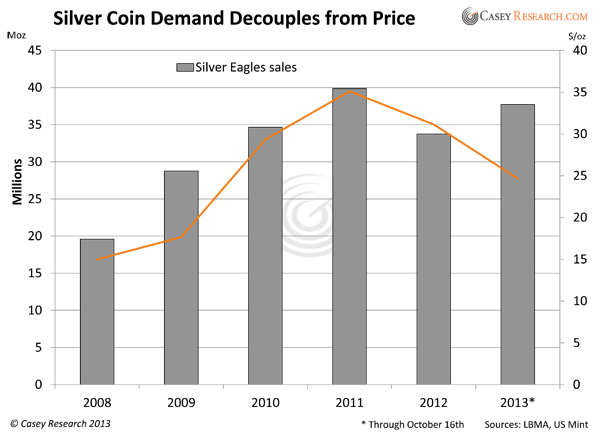

The Silver Bull Is Alive and Well

Jeff Clark, Senior Precious Metals Analyst for Casey Research, published an excellent article about the undiminished investment demand for silver this year. Gold has taken a beating from unjustly bearish investors, but the appetite for silver around the world does not seem to be fading at all. In a recent interview, Peter Schiff noted that silver is one of his most important safe haven investments thanks to its amazing upside potential.

“As of last Friday, silver is down 26.6% on the year, and down a whopping 55% since its $48.70 high on April 28, 2011. The bear market cycle is now two and a half years old—and no one can say with absolute certainty that the bottom is in.

Sounds like an investment to avoid.

For now, let’s ignore the fundamental argument for silver—an alternative currency that, like gold, will sooner or later respond to the historic levels of currency dilution throughout much of the developed world—and consider the behavior of investors. In response to the price drubbing, have they abandoned the silver market? If that were so, it might be a warning sign that we’ve overstayed our welcome.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on The Silver Bull Is Alive and Well

Doug Casey: The Waning US Economy (Audio)

Enjoy this enlightening interview with Doug Casey on This Week in Money, hosted by Jim Goddard. Casey expounds upon the failing US dollar, the importance of precious metals investing, Asian gold demand, Janet Yellen, and the broader future of the United States.

“Confidence [in the US dollar] is going to be lost more and more quickly. Non-Americans who don’t have to hold dollars…are going to be looking towards the exits… I’m very partial to the precious metals… [Gold is] at a very very reasonably priced acquisition at $1300 an ounce. I suggest that people take those dollars out from under their mattresses and trade them for gold coins.”

Listen to the Full Interview Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Interviews, Outside Commentaries

Comments Off on Doug Casey: The Waning US Economy (Audio)

Rickards: We’re In a Depression (Video)

Yesterday, on Yahoo! Finance, Jim Rickards spoke with Lauren Lyster about how Janet Yellen will perform as Chairman of the Federal Reserve. Rickards agrees with Peter Schiff, reasoning that Yellen is going to keep the stimulus flowing. He also explained why he thinks the US is actually in a depression and will be experiencing a recession within that depression next year!

“You can have a recession within a depression, in fact I expect a recession next year… This recovery is four years old. The average recovery is fifty months or so… Besides that, with the sequester, the government shutdown… Fewer and fewer people are working, so I don’t see where the drivers of growth are coming from.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries, Videos

Comments Off on Rickards: We’re In a Depression (Video)

Priced in Gold, American Wages Are Dismal

Forbes published an eye-opening op/ed by Keith Weiner of the Gold Standard Institute today. Weiner first looks at the government’s historical data on the costs of consumer goods and employee salaries. He then looks at the same data in terms of gold ounces, revealing that American workers are laboring longer for dramatically less pay than their parents. Not only that, but their purchasing power has also plummeted since the 1960s, before Nixon completely severed the US dollar from the gold standard.

“By switching to gold, we can measure both wages and prices on an absolute scale—in ounces—and we can make precise comparisons. To convert the price of anything to gold, just divide the price by the current gold price. For example, in 2011 if a big-screen TV was $785, then divide that by the gold price of that year; the television set cost half an ounce of gold.

The bottom line is that, in terms of gold, wages have fallen by about 87 percent. To get a stronger sense of what that means, consider that back in 1965, the minimum wage was 71 ounces of gold per year. In 2011, the senior engineer earned the equivalent of 63 ounces in gold. So, measured in gold, we see that senior engineers now earn less than what unskilled laborers earned back in 1965.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Priced in Gold, American Wages Are Dismal

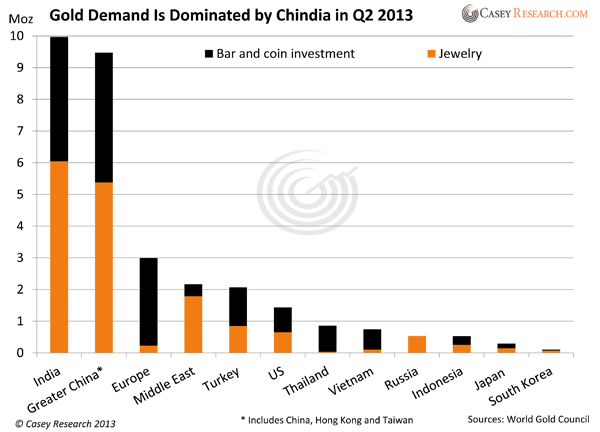

Chinese Housewives vs Goldman Sachs: No Contest

Have you had a chance to read Peter Schiff’s October Gold Letter? Besides Peter’s incisive commentary on the Fed’s “taper fakout,” Jeff Clark of Casey Research has a fascinating piece on Chinese gold demand. While Western bankers like Goldman Sachs are predicting a major downturn in the price of gold, everyday Chinese are hoarding the yellow metal like there’s no tomorrow.

“Goldman Sachs is once again predicting that gold will fall, setting a new near-term target of $1,050.

Never mind the schizophrenic gene that would be required to follow the constantly fluctuating predictions of all these big banks; it’s amazing to me that anyone continues to listen to them after their abysmal record and long-standing anti-gold stance.

Sure, the too-big-to-fails can move markets – but they say things that are good for them, not us. For example, while Goldman Sachs was telling clients and the public to sell gold in the second quarter of 2013, they bought 3.7 million shares of GLD and became the ETF’s 7th largest holder.

When I visited China two years ago, guess who no one was talking about? Goldman Sachs.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Posted in Outside Commentaries

Comments Off on Chinese Housewives vs Goldman Sachs: No Contest

Latest Silver News from The Silver Institute

The Silver Institute released their monthly Silver News this week, and it is full of interesting updates on silver investment and advances in silver technologies. This edition includes articles on silver’s use in bio-batteries made with sewage, the 12th China International Silver Conference, and the US Mint’s staggering amount of silver coin sales this year.

Download the Latest Silver News Here